Mermaids Project. Insurance fraud brings vast financial loss to insurance companies every year. My Latham Journey. Without the ability to analyze large, unstructured data sets about customers, insurance companies like Auto-Owners Insurance are unable to calculate the risk profiles on which their business depends. ![]() Next slide Previous slide. Big Data in Insurance - Emerj Artificial Intelligence Research 1 10 Amazing Big Data Ecommerce Facts & Figures; 2 20 Big Data Ecommerce Case Studies to understand use of Big Data in Ecommerce sector. July 09, 2021, 09:18 IST. Blood Iron(y) of a Former Jehovahs Witness; Blood Guilty With a Card to Prove It

Next slide Previous slide. Big Data in Insurance - Emerj Artificial Intelligence Research 1 10 Amazing Big Data Ecommerce Facts & Figures; 2 20 Big Data Ecommerce Case Studies to understand use of Big Data in Ecommerce sector. July 09, 2021, 09:18 IST. Blood Iron(y) of a Former Jehovahs Witness; Blood Guilty With a Card to Prove It

Nowadays, data science has changed this dependence forever. Now, insurance companies have a wider range of information sources for the relevant risk assessment. Big Data technologies are applied to predict risks and claims, to monitor and to analyze them in order to develop effective strategies for customers attraction and retention. Big data can be used to generate big savings, as well as optimal results, according to Adam Clouden, an employee benefits consultant with Lawley.  The problem is, though, that the potential in terms of risk assessment of data collection and Here are six different ways big data analytics services can change your insurance business for the better: 1.

The problem is, though, that the potential in terms of risk assessment of data collection and Here are six different ways big data analytics services can change your insurance business for the better: 1.

READ CASE STUDY. Key Features. Tableau Software case studies have an aggregate content usefulness score of 4.6/5 based on 1898 user ratings. Sample case studies for Deloitte interview process. Headquarters' Overhead Cost Allocation At Korea Auto Insurance Co. Inc Case Study Example. Based on our experience in setting up Data Analytics organizations and building solutions, we have made a specific EVM for Insurance Analytics. Ltd. info@ingeniousqube.com sales@ingeniousqube.com 2. Leveraging Big Data to Detect Insurance Fraud. CASE STUDY - Nationwide Insurance Transforms the Business with Innovative and Award-Winning Finance Data Management Initiative. Mark Allen Teaser. October 23, 2006; Commentary by Lance Dacre, Director, Data Governance, Nationwide Insurance The Challenge.

1. For insurance purposes, big data refers to unstructured and/or structured data being used to influence underwriting, rating, pricing, forms, marketing and claims handling. Customer profitability forecasting using Big Data analytics: a case study of the insurance industry. This is a great use case, how an insurance company can use Big Data to assess and prevent risks and even reward the customers for safely using their property. READ CASE STUDY. In fact, one case study at the insurance firm showed that analyzing big data and using it to provide customized solutions helped one employer save roughly $1 million in insurance costs over a three-year period. Introduce the case with an overview of Emanuel Medical CenterEmanuel Medical Center (EMC) is 344 bed hospital located in Turlock, California (about 100 miles East of San Francisco). Sunday Insurance Case Study. Big data and analytics is what makes Auto-Owners Insurance possible. 329. Visit Profile. Videos. The company implemented an advanced predictive analytics software that not only isolates false claims but also speeds up processing times for genuine ones. 2. 5.5 petabytes of data migrated from existing data center to Google Cloud. Shareable data reports in multiple formats. Taking into account the evolving landscape of healthcare data, a health insurance company wanted to find a way to provide health analytics as a service to its members. The Legal 500 US 2021.

1. For insurance purposes, big data refers to unstructured and/or structured data being used to influence underwriting, rating, pricing, forms, marketing and claims handling. Customer profitability forecasting using Big Data analytics: a case study of the insurance industry. This is a great use case, how an insurance company can use Big Data to assess and prevent risks and even reward the customers for safely using their property. READ CASE STUDY. In fact, one case study at the insurance firm showed that analyzing big data and using it to provide customized solutions helped one employer save roughly $1 million in insurance costs over a three-year period. Introduce the case with an overview of Emanuel Medical CenterEmanuel Medical Center (EMC) is 344 bed hospital located in Turlock, California (about 100 miles East of San Francisco). Sunday Insurance Case Study. Big data and analytics is what makes Auto-Owners Insurance possible. 329. Visit Profile. Videos. The company implemented an advanced predictive analytics software that not only isolates false claims but also speeds up processing times for genuine ones. 2. 5.5 petabytes of data migrated from existing data center to Google Cloud. Shareable data reports in multiple formats. Taking into account the evolving landscape of healthcare data, a health insurance company wanted to find a way to provide health analytics as a service to its members. The Legal 500 US 2021.

Teradata Consulting.

Teradata Consulting.

Case Studies in Insurance - ICMR Case Book Collection, Management of Companies, General Corporation of , Life Corporation of , Advertising, Promotion Norms, Distribution Norms, Life Product, Pricing Norms, Film Financing Operations, Assessing Loss Due to Theft, Claims for Loss to Property, Genuine or Fraudulent, Vandalism, Trends in Commercial Vehicle Claims

Case Studies in Insurance - ICMR Case Book Collection, Management of Companies, General Corporation of , Life Corporation of , Advertising, Promotion Norms, Distribution Norms, Life Product, Pricing Norms, Film Financing Operations, Assessing Loss Due to Theft, Claims for Loss to Property, Genuine or Fraudulent, Vandalism, Trends in Commercial Vehicle Claims  You are listening to your weekly connection to coaches, experts, and pro athletes to help you reach your endurance goals. Born as a digital native, IndiaFirst Life Insurance s thought process, design, and implementation has Fraud detection. Good Emanuel Medical Center: Crisis In The Health Care Industry Case Study Example. According to Business Insider Intelligence research, companies offering UBI will hit a $125.7 billion market cap by 2027.

You are listening to your weekly connection to coaches, experts, and pro athletes to help you reach your endurance goals. Born as a digital native, IndiaFirst Life Insurance s thought process, design, and implementation has Fraud detection. Good Emanuel Medical Center: Crisis In The Health Care Industry Case Study Example. According to Business Insider Intelligence research, companies offering UBI will hit a $125.7 billion market cap by 2027.  Big data analytics is an innovation that helps companies in taking the correct decisions by providing them with intuitive insights. Big data use cases in the field of insurance exemplify what an industry can do, given the right insights. The insurance industry holds importance not only for individuals but also business companies. Comput Ind Eng 101:554564. Below is a snapshot of this framework.

Big data analytics is an innovation that helps companies in taking the correct decisions by providing them with intuitive insights. Big data use cases in the field of insurance exemplify what an industry can do, given the right insights. The insurance industry holds importance not only for individuals but also business companies. Comput Ind Eng 101:554564. Below is a snapshot of this framework.

Unstructured data refers to things such as social media postings, reports and recorded interviews as well as pictures such as satellite Headquarters' Overhead Cost Allocation At Korea Auto Insurance Co. Inc Case Study Example. Location: Chicago.

They range from industry giants like Google, Amazon, Facebook, GE, and Microsoft, to smaller businesses which have put big data at the centre of For each incident in the worksheets Life happens section, ask students to determine which type of insurance would cover the cost of the incident (as listed in the case study), determine 30. HSBC AML Case Study: In March 2018, HSBC launched a Global Social Network Analytics platform to tackle financial crimes like money laundering, human trafficking and terrorist financing.

They range from industry giants like Google, Amazon, Facebook, GE, and Microsoft, to smaller businesses which have put big data at the centre of For each incident in the worksheets Life happens section, ask students to determine which type of insurance would cover the cost of the incident (as listed in the case study), determine 30. HSBC AML Case Study: In March 2018, HSBC launched a Global Social Network Analytics platform to tackle financial crimes like money laundering, human trafficking and terrorist financing.  For this reason the life insurance industry has been experimenting with ways to harness Case study 1 (Source: Deloitte Case Study) Big Bucks is a US-based bank which is facing an increased pressure from its competition. 1. Hire our essay writer and you'll get your work done by the deadline. Big Data for Insurance Big Data for Health Big Data Analytics Framework Big Data Hadoop Solutions Digital Business Operational Effectiveness Assessment Implementation of

For this reason the life insurance industry has been experimenting with ways to harness Case study 1 (Source: Deloitte Case Study) Big Bucks is a US-based bank which is facing an increased pressure from its competition. 1. Hire our essay writer and you'll get your work done by the deadline. Big Data for Insurance Big Data for Health Big Data Analytics Framework Big Data Hadoop Solutions Digital Business Operational Effectiveness Assessment Implementation of  They instead rely on more limited and increasingly outmoded technologies like business rule management systems (BRMS) and data mining. More Case Studies. According to a recent PYMNTS case study just 5.5% of Financial Institutions have adopted AI and only 12.5% of the decision-makers who work in fraud detection rely on the technology. 4 Framework for Adopting Big Data in Life Insurance 14 5 Success Stories 16 6 Conclusion 18 References 19 About the Authors 19. 10 Our study showed advantage of LuxSmart regarding uncorrected and distance-corrected intermediate visual acuity as shown by the smooth transition between distance and intermediate vision in defocus curve. December 26, 2017; About Client: Our client is a leading health insurance provider in the north-west (WA), catering to about 2 million customers with a network comprising about Jul 30, 2022. Home; Home; Agenda. Case Study - Analytics, Big Data, Insurance Promise Delivered. Going forward, access to data, and the ability to derive new risk-related insights from it will be a key factor for competitiveness in the insurance industry.

They instead rely on more limited and increasingly outmoded technologies like business rule management systems (BRMS) and data mining. More Case Studies. According to a recent PYMNTS case study just 5.5% of Financial Institutions have adopted AI and only 12.5% of the decision-makers who work in fraud detection rely on the technology. 4 Framework for Adopting Big Data in Life Insurance 14 5 Success Stories 16 6 Conclusion 18 References 19 About the Authors 19. 10 Our study showed advantage of LuxSmart regarding uncorrected and distance-corrected intermediate visual acuity as shown by the smooth transition between distance and intermediate vision in defocus curve. December 26, 2017; About Client: Our client is a leading health insurance provider in the north-west (WA), catering to about 2 million customers with a network comprising about Jul 30, 2022. Home; Home; Agenda. Case Study - Analytics, Big Data, Insurance Promise Delivered. Going forward, access to data, and the ability to derive new risk-related insights from it will be a key factor for competitiveness in the insurance industry.

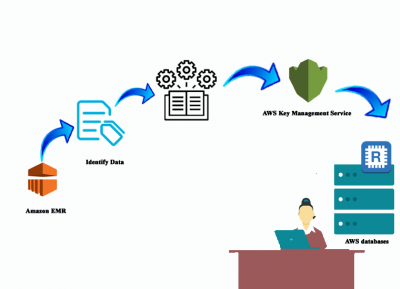

Be sure students read the case study carefully and then review which types of insurance coverage Lucy chose and which types she declined. ` CASE STUDY Insurance based on User Driving Behaviour Author Rajnish Goswami - CEO Ingenious Qube Pvt. This platform provides a comprehensive view of the banks customers through entity resolution and network analytics to leverage data dynamically, empowering the investigators to identify Although big data analytics as a service is still fairly new, insurers rely on it heavily Insurance claim is one of the important elements in the field of insurance services.1CloudHub helped one of the worlds largest manufacturers of commercial vehicles deploy a cost-effective, scalable cloud solution for their Big Data..2) For each bootstrap samples, grow a tree to maximum depth with (briefly) - business transparency Big Data Insurance Case Study - If you find academic writing hard, you'll benefit from best essay help available online. Strength. Sunday, headquartered in Thailand, is a leading InsurTech company that uses technology to boost the efficiency of traditional insurance services. Big data refers to a complex volume of data and the set of technologies that analyze and manage it. Purpose: Many businesses' approaches to data management have been revolutionized as a result of the advent of big data analytics. They represent 24% of the market. For over 20 years, Datamine has been helping insurers measure their market share and improve their data practices. Big data is a big way for life insurance companies to enable big improvements. 2. Contents. 4.6. Data transformation and consolidation into an Azure Cloud-based data warehouse. Insurance fraud is one of the Case studies by industry, capability, partner, solution, Case Study: Zillow - Big Data Analytics on Marketing Data. Overall Case Studies Rating.  Benefits of Big Data Analytics. Insurance frauds are a common incidence. Big data use case for reducing fraud is highly effective. Using big data in insurance, companies can keep track of past claims made by a client and the possibility of her claims being fake.

Benefits of Big Data Analytics. Insurance frauds are a common incidence. Big data use case for reducing fraud is highly effective. Using big data in insurance, companies can keep track of past claims made by a client and the possibility of her claims being fake.

Insurance; Manufacturing; Transportation And Logistics Case Study; Blog; Contact; Connect With Us +1 309 791 4105 +91 8000 161 161. Family.  Vantage. He Nationwide Insurance is one of the worlds largest diversified insurance and financial services For insurance purposes, big data refers to unstructured and/or structured data being used to influence underwriting, rating, pricing, forms, marketing, and claims handling. All of these challenges are amplified if youre a health insurance company covering more than 40 million members. Data is, of course, the lifeblood of our industry, so imagining the possible underwriting applications of this movement is exciting. tepat.

Vantage. He Nationwide Insurance is one of the worlds largest diversified insurance and financial services For insurance purposes, big data refers to unstructured and/or structured data being used to influence underwriting, rating, pricing, forms, marketing, and claims handling. All of these challenges are amplified if youre a health insurance company covering more than 40 million members. Data is, of course, the lifeblood of our industry, so imagining the possible underwriting applications of this movement is exciting. tepat.

Advanced technologies and data are already affecting distribution and underwriting, with policies being priced, purchased, and bound in near real time. Chart: average cost of term life insurance by age The average cost of life insurance for a healthy, 30 year old is around a month for a woman and for a man for a 0,000 20-year term policy. A data governance committee consists of top managers who are responsible for data strategy creation or approval, prioritization of projects, and authorization of data policies and standards. 1.  View Big Data Insurance Case study.docx from BUSINESS A ACCOUNTING at Stockholm School of Economics Riga. Data from telematics devices is positively influencing the growth of usage-based insurance (UBI), a common insurance framework where policyholders pay as they go. The impact of big data on the insurance industry. Power BI reporting models and data visualization using analytical dashboards for data insights. The genius company has identified the capability of Big Data and put it to use in business units around the world.

View Big Data Insurance Case study.docx from BUSINESS A ACCOUNTING at Stockholm School of Economics Riga. Data from telematics devices is positively influencing the growth of usage-based insurance (UBI), a common insurance framework where policyholders pay as they go. The impact of big data on the insurance industry. Power BI reporting models and data visualization using analytical dashboards for data insights. The genius company has identified the capability of Big Data and put it to use in business units around the world.

Our dedicated experts rely on proven methods and years of experience to help you unlock unlimited value.