To help you decide, here are how these types of transactions compare to other payment options. On the other hand, credit cards typically charge 2.5% of the transaction value in fees, plus an additional processing fee. 6 reasons it makes sense to use ACH via GoCardless to collect payments. Well take care of it for you. Statement, ACH Direct named to prestigious Inc. 5000 list for fifth consecutive year, ACH Direct Makes the Inc. 5000 Fastest-Growing Companies for Fourth Year in a Row, Free Webinar Series Presented by ACH Direct, Inc. Continues with "Unauthorized Entries and Stop Payments", Striata and Payments Gateway Partner to Securely Deliver Property Tax Bills Electronically, ACH Direct's Free Webinar Series Continues with "Authorization Requirements", Payments Gateway Partners with Trustwave to Offer Merchants PCI Compliance Solutions. Then it has 45 more days to investigate. Are ACH payments right for you? processing There are two ways to make ACH payments ACH debit and ACH credit. Also, not everyone has a credit card or wants to pay with one, so offering ACH is not only about lowering costs, but serving more people. No matter how you add it, every invoice is stored in the same place, so you can find them whenever you need them. Broadly speaking, ACH transactions have the lowest costs associated with any payment system. Getting customers who are used to paying with credit cards to switch to ACH may take a little persuasion. payments tenant Individuals and businesses can send and receive ACH payments. void ach As customers start making the switch to ACH in bulk, issues will surely arise. The transactions are made via the ACH network governed by Nacha, or the National Automated Clearing House Association and serve as a natural alternative to payments via credit card networks. Plus, you may need to contact your bank to stop payment on the missing check. Just like credit card fees, there are no set prices for ACH transactions. ACHcreditsare when you accept paymentsfromsomeone else. GoCardless helps you automate payment collection, cutting down on the amount of admin your team needs to deal with when chasing invoices.  EFT is a general term that covers many different methods of electronically transferring money from one bank to another, including wire transfers, credit and debit card payments and ACH payments. debit ach card cheat sheet thank inbox shortly authorization Given that ACH payments dont settle immediately, purchases can be made without sufficient funds in the purchasers bank account, only to later have that transaction rejected by the ACH networkafter goods are sent. ACH Transfer vs Wire Transfer: The Payment Choice Is Clear. Once the invoice is approved, you can pay it for one low, flat ACH fee by clicking the Pay button. Lets look at what ACH payments are, how they work and what you should know when making an ACH payment. Credit Karma is committed to ensuring digital accessibility for people with disabilities. Trillions of dollars yes, thats trillions with a T move through the ACH system each year. A business that is going to use ACH for payments needs to make sure theyre following Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations. To remedy this, some ACH solutions have balance check tools that check to ensure the customer has enough funds in their account to cover the transaction. The ACH processor receives the instructions from the bank, sorts them into separate files for every bank from which it needs to pull customer payments, and sends payment instructions to each bank. Concerns persist about customer experience, fraud risk and liability, and a lack of understanding on how it works.

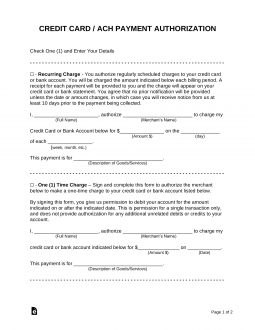

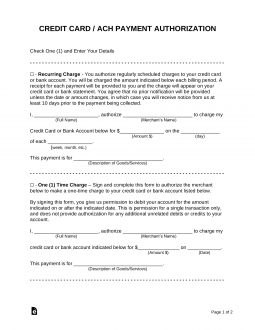

EFT is a general term that covers many different methods of electronically transferring money from one bank to another, including wire transfers, credit and debit card payments and ACH payments. debit ach card cheat sheet thank inbox shortly authorization Given that ACH payments dont settle immediately, purchases can be made without sufficient funds in the purchasers bank account, only to later have that transaction rejected by the ACH networkafter goods are sent. ACH Transfer vs Wire Transfer: The Payment Choice Is Clear. Once the invoice is approved, you can pay it for one low, flat ACH fee by clicking the Pay button. Lets look at what ACH payments are, how they work and what you should know when making an ACH payment. Credit Karma is committed to ensuring digital accessibility for people with disabilities. Trillions of dollars yes, thats trillions with a T move through the ACH system each year. A business that is going to use ACH for payments needs to make sure theyre following Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations. To remedy this, some ACH solutions have balance check tools that check to ensure the customer has enough funds in their account to cover the transaction. The ACH processor receives the instructions from the bank, sorts them into separate files for every bank from which it needs to pull customer payments, and sends payment instructions to each bank. Concerns persist about customer experience, fraud risk and liability, and a lack of understanding on how it works.  ach App Store is a service mark of Apple Inc. Instead of having another company pull payments from your checking or savings account, you push payments from your account. If you invite them to the network, the vendor willreceive an emailasking them to fill out their own info for the Bill.com system. There are 3 easy ways to enter any invoice into the Bill.com system: Have your vendor email it directly to your Bill.com dedicated email address, Or snap a picture of it in the Bill.com mobile app. And combining it with NetSuite is seamless., We transitioned from a paper file system for payables to Bill.com four years ago and have never looked back. You dont have to worry about waiting for your bill to arrive, staying on top of payment deadlines, or buying postage. Todays ACH network offers the option of same-day, next-day, or 2-day payments. Another key point of difference between ACH and credit cards is their respective processing times. Bill.com lets you set up your own approval rules however you need to. This site requires Javascript for full functionality. cvv card credit generator number visa master cvc valid cvv2 bulk fake payment sample asked someone security frequently questions mean The term ACH refers only to direct payments that take place on the ACH network. If youve everset up ACHautomatic bank payments for something like rent, mortgage, or a utility bill, you probably had to fill out and sign a form that asked you for your personal information, your bank account information, and probably an image of a voided check, along with your signature. As you can see, ACH and credit card payments both allow you to take recurring payments simply and easily. After the request is approved or denied by the acquiring bank, its sent on to the issuing bank, where the transfer to your merchant bank account is finalized. Modern bank-account verification methods have changed all that, as customers can now connect their bank accounts for ACH payments in seconds, rather than days. This shows that smaller, internet-initiated payments are the strongest growth area for ACH, which could expand beyond P2P apps into areas like mobile shopping. However, that doesnt mean the risk doesnt exist.

ach App Store is a service mark of Apple Inc. Instead of having another company pull payments from your checking or savings account, you push payments from your account. If you invite them to the network, the vendor willreceive an emailasking them to fill out their own info for the Bill.com system. There are 3 easy ways to enter any invoice into the Bill.com system: Have your vendor email it directly to your Bill.com dedicated email address, Or snap a picture of it in the Bill.com mobile app. And combining it with NetSuite is seamless., We transitioned from a paper file system for payables to Bill.com four years ago and have never looked back. You dont have to worry about waiting for your bill to arrive, staying on top of payment deadlines, or buying postage. Todays ACH network offers the option of same-day, next-day, or 2-day payments. Another key point of difference between ACH and credit cards is their respective processing times. Bill.com lets you set up your own approval rules however you need to. This site requires Javascript for full functionality. cvv card credit generator number visa master cvc valid cvv2 bulk fake payment sample asked someone security frequently questions mean The term ACH refers only to direct payments that take place on the ACH network. If youve everset up ACHautomatic bank payments for something like rent, mortgage, or a utility bill, you probably had to fill out and sign a form that asked you for your personal information, your bank account information, and probably an image of a voided check, along with your signature. As you can see, ACH and credit card payments both allow you to take recurring payments simply and easily. After the request is approved or denied by the acquiring bank, its sent on to the issuing bank, where the transfer to your merchant bank account is finalized. Modern bank-account verification methods have changed all that, as customers can now connect their bank accounts for ACH payments in seconds, rather than days. This shows that smaller, internet-initiated payments are the strongest growth area for ACH, which could expand beyond P2P apps into areas like mobile shopping. However, that doesnt mean the risk doesnt exist.  Our end-to-end security offers added peace of mind, as ACH Direct is fully compliant with the Payment Card Industry (PCI) standards. Still, businesses may be able to offset the cost of ACH payments by lowering or avoiding credit card processing fees and the labor involved in processing paper checks.

Our end-to-end security offers added peace of mind, as ACH Direct is fully compliant with the Payment Card Industry (PCI) standards. Still, businesses may be able to offset the cost of ACH payments by lowering or avoiding credit card processing fees and the labor involved in processing paper checks.

Tom is a writer at Plaid. 2 min read .css-rqgsqp{position:relative;z-index:1;}.css-fp7fcu{-webkit-align-items:baseline;-webkit-box-align:baseline;-ms-flex-align:baseline;align-items:baseline;margin:0;padding:0;-webkit-appearance:none;-moz-appearance:none;-ms-appearance:none;appearance:none;-webkit-user-select:none;-moz-user-select:none;-ms-user-select:none;user-select:none;border:none;border-radius:0;background:none;font-family:inherit;font-weight:inherit;font-size:inherit;line-height:inherit;color:inherit;width:auto;cursor:pointer;-webkit-text-decoration:none;text-decoration:none;-webkit-box-flex-wrap:nowrap;-webkit-flex-wrap:nowrap;-ms-flex-wrap:nowrap;flex-wrap:nowrap;text-align:left;font-size:inherit;line-height:inherit;background-color:transparent;color:#2c2d2f;font-size:16px;line-height:24px;width:auto;display:-webkit-inline-box;display:-webkit-inline-flex;display:-ms-inline-flexbox;display:inline-flex;}a.css-fp7fcu{-webkit-user-select:auto;-moz-user-select:auto;-ms-user-select:auto;user-select:auto;}button.css-fp7fcu{-webkit-user-select:none;-moz-user-select:none;-ms-user-select:none;user-select:none;}.css-fp7fcu:hover,.css-fp7fcu[data-hover]{-webkit-text-decoration:underline;text-decoration:underline;}.css-fp7fcu:hover,.css-fp7fcu:focus,.css-fp7fcu[data-focus]{background-color:transparent;color:#2c2d2f;}.css-fp7fcu:focus,.css-fp7fcu[data-focus]{outline:2px solid #7e9bf0;}.css-fp7fcu:active,.css-fp7fcu[data-active]{background-color:transparent;color:#2c2d2f;}.css-fp7fcu:disabled,.css-fp7fcu[disabled]{background:transparent;border-color:transparent;color:#8f9197;}.css-fp7fcu:disabled,.css-fp7fcu[disabled]{cursor:not-allowed;-webkit-text-decoration:none;text-decoration:none;}.css-1lzvamb{-webkit-align-items:baseline;-webkit-box-align:baseline;-ms-flex-align:baseline;align-items:baseline;margin:0;padding:0;-webkit-appearance:none;-moz-appearance:none;-ms-appearance:none;appearance:none;-webkit-user-select:none;-moz-user-select:none;-ms-user-select:none;user-select:none;border:none;border-radius:0;background:none;font-family:inherit;font-weight:inherit;font-size:inherit;line-height:inherit;color:inherit;width:auto;cursor:pointer;-webkit-text-decoration:none;text-decoration:none;-webkit-box-flex-wrap:nowrap;-webkit-flex-wrap:nowrap;-ms-flex-wrap:nowrap;flex-wrap:nowrap;text-align:left;font-size:inherit;line-height:inherit;background-color:transparent;color:#2c2d2f;font-size:16px;line-height:24px;width:auto;display:-webkit-inline-box;display:-webkit-inline-flex;display:-ms-inline-flexbox;display:inline-flex;position:relative;z-index:1;}a.css-1lzvamb{-webkit-user-select:auto;-moz-user-select:auto;-ms-user-select:auto;user-select:auto;}button.css-1lzvamb{-webkit-user-select:none;-moz-user-select:none;-ms-user-select:none;user-select:none;}.css-1lzvamb:hover,.css-1lzvamb[data-hover]{-webkit-text-decoration:underline;text-decoration:underline;}.css-1lzvamb:hover,.css-1lzvamb:focus,.css-1lzvamb[data-focus]{background-color:transparent;color:#2c2d2f;}.css-1lzvamb:focus,.css-1lzvamb[data-focus]{outline:2px solid #7e9bf0;}.css-1lzvamb:active,.css-1lzvamb[data-active]{background-color:transparent;color:#2c2d2f;}.css-1lzvamb:disabled,.css-1lzvamb[disabled]{background:transparent;border-color:transparent;color:#8f9197;}.css-1lzvamb:disabled,.css-1lzvamb[disabled]{cursor:not-allowed;-webkit-text-decoration:none;text-decoration:none;}Small Business, Guide to Cutting Costs to Increase Profits, Financial Planning for Nonprofit Organizations, Interested in automating the way you get paid? It's pretty simple, actually. Without a balance check tool, a business is at a higher risk of sending goods before receiving payment and customers are at a higher risk of unwittingly incurring overdraft fees. Recurring payments built for subscriptions, Training resources, documentation, and more. However, there are three main differences that it may be beneficial to highlight: the guarantee of payment, automated clearing house processing times, and fees. Also, since businesses can pass payment processing fees on to consumers, lowering the cost of doing business with ACH payments can mean lower costs for their customers. Image: A woman holding a document sits on the floor and uses her laptop and cellphone to assess her finances. Point-in-time snapshots of users' finances, Student loan, credit card, and mortgage data, Plaid builds connections that enable you to securely share your data, Plaid lets you securely share data from your financial institution with the apps you choose, Plaid powers the apps in your financial life, The pitfalls of ACH and how to avoid them, ACH benefits businesses and customers alike. However, for most transactions, ACH is much cheaper than credit cards. ACH is widely used for many types of payments, including internet-initiated payments, peer-to-peer (P2P) payments, and direct deposits. payment prcua carte blanche gateway dss compliant pci certified fully secure pa through diners club This means theyll need to take actions such as verifying the customers identity, engaging in ongoing monitoring, and ensuring funds arent being used for money laundering or terrorism financing. It has to do with whos initiating the transfer. ACH Direct is the only payment processor you'll ever need. Essentially, ACH transactions are bank-to-bank payments for businesses in the United States. In addition to our industry-leading ACH solutions, we offer single and recurring credit card and debit card transaction processing. For regularly recurring payments such as monthly subscriptions, theres no reason for businesses to pay high processing fees every month.

However, for most transactions, ACH is much cheaper than credit cards. ACH is widely used for many types of payments, including internet-initiated payments, peer-to-peer (P2P) payments, and direct deposits. payment prcua carte blanche gateway dss compliant pci certified fully secure pa through diners club This means theyll need to take actions such as verifying the customers identity, engaging in ongoing monitoring, and ensuring funds arent being used for money laundering or terrorism financing. It has to do with whos initiating the transfer. ACH Direct is the only payment processor you'll ever need. Essentially, ACH transactions are bank-to-bank payments for businesses in the United States. In addition to our industry-leading ACH solutions, we offer single and recurring credit card and debit card transaction processing. For regularly recurring payments such as monthly subscriptions, theres no reason for businesses to pay high processing fees every month.

iPhone is a trademark of Apple Inc., registered in the U.S. and other countries. Those points can be redeemed at several businesses, including Starbucks, Amazon, and Netflix. Better yet, Bill.com syncs with most major accounting software platforms, so you wont have to enter that payment twice. Businesses that accept ACH can create additional features that both benefit users and promote ACH payments. Then the recipient needs to process the mail and deposit the check. One of the common objections to using ACH for payments is that it takes too long to settle. Traditionally, ACH verification methods such as microdeposits and voided checks could take up to five days to process. People might use the terms ACH and EFT (electronic funds transfer) interchangeably, but theyre not the same. Find out how GoCardless can help you with ad hoc payments or recurring payments. We needed systems that were easy to implement and would serve as strong tools for our finance team. For customers to make the switch to ACH, it needs to be easy. With this type of payment you dont have to use paper checks, wire transfers, credit card networks or cash. ach

This is especially true for recurring payments like software subscriptions. Even though theyre electronic payments, it usually takes 24 business days for the transfer to complete. Box 30963, Oakland, CA 94604, Image: Young woman using a laptop in a cafe, Click to share on Twitter (Opens in new window), Click to share on Facebook (Opens in new window), Click to share on Reddit (Opens in new window), Credit Karma Money Spend 100% free to open, Image: Woman on couch looking at laptop, figuring out how much money to keep in her checking account, Image: Young man sitting on floor at home with digital tablet, looking up how to set up direct deposit, Image: Couple in kitchen with cellphone, talking about how to transfer money from bank to bank, Image: Man holding bill and calculator, figuring out why he was charged and NSF fee, Image: Woman at home in a sunlit room, wondering what a monthly maintenance fee is. One reason wire transfers may cost more is that theyre processed individually on a transaction-by-transaction basis directly from bank to bank, while ACH transactions are batched together for processing through a clearinghouse. So you dont have to worry about keeping enough money in your account to cover those checkspayments that might hit your account anywhere up to a month or more after you sent them. With online cart checkouts that make ACH as easy to use as a credit card once a bank account is linkedalong with the tools available to overcome some of ACHs setbacksits a viable option for businesses tired of paying high payment processing costs. Bill.com, the Bill.com logo, and the b logo are trademarks of Bill.com, LLC. First question: what is an automated clearing house transaction, anyway? All ACH payments are EFT payments, but not all EFTs are ACH. Take control: stop chasing late payments and save yourself time, money and stress. Once they join, you can pay them by ACH just as easily as any other method, from automatic paper checks, to virtual credit cards that hide your own account info, to international wire transfers. ach stored manage

On the Bill.com platform, making or receiving any ACH payment is very straightforward. 2022 Bill.com, LLC. ACH, EFT and eChecks: Which Is Right for My Business? 2006-2012 ACH Direct, Inc. All rights reserved. For affected companies, switching to ACH offers a simple way to increase long-term revenue by reducing payment churn. Its also safer than using paper checks, which can get lost, or worse, putting your name, address, and bank account info into the wrong hands and exposing you to check fraud. And, because of the way the system is set up, ACH payments can be stopped or returned under certain circumstances, much like other methods of transferring funds. By contrast, credit card processing times are slightly faster (it can be anywhere from 24 hours to three days from the transaction, although usually, youll receive payment immediately), which can improve your cash flow and boost liquidity. Thats all good information to have if you feel like talking about ACH payments with a banker, but none of it really matters if youre in the Bill.com system. And its much faster than sending a checknot just for your vendor, but for your own accounting. By making the ACH-payment experience user-friendly and easier to complete the onboarding processusers may be more likely to use it, leading to greater savings on fees over time. Dont give out your bank account information over the phone or online unless youre sure youre dealing with a reputable company. Why do so many businesses use the ACH system? Some may already prefer to pay with their bank account, such as the 57% of 18-31 year old Americans who dont have a rewards credit card. .css-y3jkrv{-webkit-align-items:baseline;-webkit-box-align:baseline;-ms-flex-align:baseline;align-items:baseline;margin:0;padding:0;-webkit-appearance:none;-moz-appearance:none;-ms-appearance:none;appearance:none;-webkit-user-select:none;-moz-user-select:none;-ms-user-select:none;user-select:none;border:none;border-radius:0;background:none;font-family:inherit;font-weight:inherit;font-size:inherit;line-height:inherit;color:inherit;width:auto;cursor:pointer;-webkit-text-decoration:none;text-decoration:none;-webkit-box-flex-wrap:nowrap;-webkit-flex-wrap:nowrap;-ms-flex-wrap:nowrap;flex-wrap:nowrap;text-align:left;font-size:inherit;line-height:inherit;background-color:transparent;color:#fbfbfb;font-size:16px;line-height:24px;width:auto;display:inline;}a.css-y3jkrv{-webkit-user-select:auto;-moz-user-select:auto;-ms-user-select:auto;user-select:auto;}button.css-y3jkrv{-webkit-user-select:none;-moz-user-select:none;-ms-user-select:none;user-select:none;}.css-y3jkrv:hover,.css-y3jkrv[data-hover]{-webkit-text-decoration:underline;text-decoration:underline;}.css-y3jkrv:hover,.css-y3jkrv:focus,.css-y3jkrv[data-focus]{background-color:transparent;color:#fbfbfb;}.css-y3jkrv:focus,.css-y3jkrv[data-focus]{outline:2px solid #7e9bf0;}.css-y3jkrv:active,.css-y3jkrv[data-active]{background-color:transparent;color:#f3f4f5;}.css-y3jkrv:disabled,.css-y3jkrv[disabled]{background:transparent;border-color:transparent;color:#8f9197;}.css-y3jkrv:disabled,.css-y3jkrv[disabled]{cursor:not-allowed;-webkit-text-decoration:none;text-decoration:none;}Learn more, GoCardless Ltd., 333 Bush St 4th Floor, San Francisco, CA 94104, USA.

EFT is a general term that covers many different methods of electronically transferring money from one bank to another, including wire transfers, credit and debit card payments and ACH payments. debit ach card cheat sheet thank inbox shortly authorization Given that ACH payments dont settle immediately, purchases can be made without sufficient funds in the purchasers bank account, only to later have that transaction rejected by the ACH networkafter goods are sent. ACH Transfer vs Wire Transfer: The Payment Choice Is Clear. Once the invoice is approved, you can pay it for one low, flat ACH fee by clicking the Pay button. Lets look at what ACH payments are, how they work and what you should know when making an ACH payment. Credit Karma is committed to ensuring digital accessibility for people with disabilities. Trillions of dollars yes, thats trillions with a T move through the ACH system each year. A business that is going to use ACH for payments needs to make sure theyre following Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations. To remedy this, some ACH solutions have balance check tools that check to ensure the customer has enough funds in their account to cover the transaction. The ACH processor receives the instructions from the bank, sorts them into separate files for every bank from which it needs to pull customer payments, and sends payment instructions to each bank. Concerns persist about customer experience, fraud risk and liability, and a lack of understanding on how it works.

EFT is a general term that covers many different methods of electronically transferring money from one bank to another, including wire transfers, credit and debit card payments and ACH payments. debit ach card cheat sheet thank inbox shortly authorization Given that ACH payments dont settle immediately, purchases can be made without sufficient funds in the purchasers bank account, only to later have that transaction rejected by the ACH networkafter goods are sent. ACH Transfer vs Wire Transfer: The Payment Choice Is Clear. Once the invoice is approved, you can pay it for one low, flat ACH fee by clicking the Pay button. Lets look at what ACH payments are, how they work and what you should know when making an ACH payment. Credit Karma is committed to ensuring digital accessibility for people with disabilities. Trillions of dollars yes, thats trillions with a T move through the ACH system each year. A business that is going to use ACH for payments needs to make sure theyre following Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations. To remedy this, some ACH solutions have balance check tools that check to ensure the customer has enough funds in their account to cover the transaction. The ACH processor receives the instructions from the bank, sorts them into separate files for every bank from which it needs to pull customer payments, and sends payment instructions to each bank. Concerns persist about customer experience, fraud risk and liability, and a lack of understanding on how it works.  ach App Store is a service mark of Apple Inc. Instead of having another company pull payments from your checking or savings account, you push payments from your account. If you invite them to the network, the vendor willreceive an emailasking them to fill out their own info for the Bill.com system. There are 3 easy ways to enter any invoice into the Bill.com system: Have your vendor email it directly to your Bill.com dedicated email address, Or snap a picture of it in the Bill.com mobile app. And combining it with NetSuite is seamless., We transitioned from a paper file system for payables to Bill.com four years ago and have never looked back. You dont have to worry about waiting for your bill to arrive, staying on top of payment deadlines, or buying postage. Todays ACH network offers the option of same-day, next-day, or 2-day payments. Another key point of difference between ACH and credit cards is their respective processing times. Bill.com lets you set up your own approval rules however you need to. This site requires Javascript for full functionality. cvv card credit generator number visa master cvc valid cvv2 bulk fake payment sample asked someone security frequently questions mean The term ACH refers only to direct payments that take place on the ACH network. If youve everset up ACHautomatic bank payments for something like rent, mortgage, or a utility bill, you probably had to fill out and sign a form that asked you for your personal information, your bank account information, and probably an image of a voided check, along with your signature. As you can see, ACH and credit card payments both allow you to take recurring payments simply and easily. After the request is approved or denied by the acquiring bank, its sent on to the issuing bank, where the transfer to your merchant bank account is finalized. Modern bank-account verification methods have changed all that, as customers can now connect their bank accounts for ACH payments in seconds, rather than days. This shows that smaller, internet-initiated payments are the strongest growth area for ACH, which could expand beyond P2P apps into areas like mobile shopping. However, that doesnt mean the risk doesnt exist.

ach App Store is a service mark of Apple Inc. Instead of having another company pull payments from your checking or savings account, you push payments from your account. If you invite them to the network, the vendor willreceive an emailasking them to fill out their own info for the Bill.com system. There are 3 easy ways to enter any invoice into the Bill.com system: Have your vendor email it directly to your Bill.com dedicated email address, Or snap a picture of it in the Bill.com mobile app. And combining it with NetSuite is seamless., We transitioned from a paper file system for payables to Bill.com four years ago and have never looked back. You dont have to worry about waiting for your bill to arrive, staying on top of payment deadlines, or buying postage. Todays ACH network offers the option of same-day, next-day, or 2-day payments. Another key point of difference between ACH and credit cards is their respective processing times. Bill.com lets you set up your own approval rules however you need to. This site requires Javascript for full functionality. cvv card credit generator number visa master cvc valid cvv2 bulk fake payment sample asked someone security frequently questions mean The term ACH refers only to direct payments that take place on the ACH network. If youve everset up ACHautomatic bank payments for something like rent, mortgage, or a utility bill, you probably had to fill out and sign a form that asked you for your personal information, your bank account information, and probably an image of a voided check, along with your signature. As you can see, ACH and credit card payments both allow you to take recurring payments simply and easily. After the request is approved or denied by the acquiring bank, its sent on to the issuing bank, where the transfer to your merchant bank account is finalized. Modern bank-account verification methods have changed all that, as customers can now connect their bank accounts for ACH payments in seconds, rather than days. This shows that smaller, internet-initiated payments are the strongest growth area for ACH, which could expand beyond P2P apps into areas like mobile shopping. However, that doesnt mean the risk doesnt exist.  Our end-to-end security offers added peace of mind, as ACH Direct is fully compliant with the Payment Card Industry (PCI) standards. Still, businesses may be able to offset the cost of ACH payments by lowering or avoiding credit card processing fees and the labor involved in processing paper checks.

Our end-to-end security offers added peace of mind, as ACH Direct is fully compliant with the Payment Card Industry (PCI) standards. Still, businesses may be able to offset the cost of ACH payments by lowering or avoiding credit card processing fees and the labor involved in processing paper checks. Tom is a writer at Plaid. 2 min read .css-rqgsqp{position:relative;z-index:1;}.css-fp7fcu{-webkit-align-items:baseline;-webkit-box-align:baseline;-ms-flex-align:baseline;align-items:baseline;margin:0;padding:0;-webkit-appearance:none;-moz-appearance:none;-ms-appearance:none;appearance:none;-webkit-user-select:none;-moz-user-select:none;-ms-user-select:none;user-select:none;border:none;border-radius:0;background:none;font-family:inherit;font-weight:inherit;font-size:inherit;line-height:inherit;color:inherit;width:auto;cursor:pointer;-webkit-text-decoration:none;text-decoration:none;-webkit-box-flex-wrap:nowrap;-webkit-flex-wrap:nowrap;-ms-flex-wrap:nowrap;flex-wrap:nowrap;text-align:left;font-size:inherit;line-height:inherit;background-color:transparent;color:#2c2d2f;font-size:16px;line-height:24px;width:auto;display:-webkit-inline-box;display:-webkit-inline-flex;display:-ms-inline-flexbox;display:inline-flex;}a.css-fp7fcu{-webkit-user-select:auto;-moz-user-select:auto;-ms-user-select:auto;user-select:auto;}button.css-fp7fcu{-webkit-user-select:none;-moz-user-select:none;-ms-user-select:none;user-select:none;}.css-fp7fcu:hover,.css-fp7fcu[data-hover]{-webkit-text-decoration:underline;text-decoration:underline;}.css-fp7fcu:hover,.css-fp7fcu:focus,.css-fp7fcu[data-focus]{background-color:transparent;color:#2c2d2f;}.css-fp7fcu:focus,.css-fp7fcu[data-focus]{outline:2px solid #7e9bf0;}.css-fp7fcu:active,.css-fp7fcu[data-active]{background-color:transparent;color:#2c2d2f;}.css-fp7fcu:disabled,.css-fp7fcu[disabled]{background:transparent;border-color:transparent;color:#8f9197;}.css-fp7fcu:disabled,.css-fp7fcu[disabled]{cursor:not-allowed;-webkit-text-decoration:none;text-decoration:none;}.css-1lzvamb{-webkit-align-items:baseline;-webkit-box-align:baseline;-ms-flex-align:baseline;align-items:baseline;margin:0;padding:0;-webkit-appearance:none;-moz-appearance:none;-ms-appearance:none;appearance:none;-webkit-user-select:none;-moz-user-select:none;-ms-user-select:none;user-select:none;border:none;border-radius:0;background:none;font-family:inherit;font-weight:inherit;font-size:inherit;line-height:inherit;color:inherit;width:auto;cursor:pointer;-webkit-text-decoration:none;text-decoration:none;-webkit-box-flex-wrap:nowrap;-webkit-flex-wrap:nowrap;-ms-flex-wrap:nowrap;flex-wrap:nowrap;text-align:left;font-size:inherit;line-height:inherit;background-color:transparent;color:#2c2d2f;font-size:16px;line-height:24px;width:auto;display:-webkit-inline-box;display:-webkit-inline-flex;display:-ms-inline-flexbox;display:inline-flex;position:relative;z-index:1;}a.css-1lzvamb{-webkit-user-select:auto;-moz-user-select:auto;-ms-user-select:auto;user-select:auto;}button.css-1lzvamb{-webkit-user-select:none;-moz-user-select:none;-ms-user-select:none;user-select:none;}.css-1lzvamb:hover,.css-1lzvamb[data-hover]{-webkit-text-decoration:underline;text-decoration:underline;}.css-1lzvamb:hover,.css-1lzvamb:focus,.css-1lzvamb[data-focus]{background-color:transparent;color:#2c2d2f;}.css-1lzvamb:focus,.css-1lzvamb[data-focus]{outline:2px solid #7e9bf0;}.css-1lzvamb:active,.css-1lzvamb[data-active]{background-color:transparent;color:#2c2d2f;}.css-1lzvamb:disabled,.css-1lzvamb[disabled]{background:transparent;border-color:transparent;color:#8f9197;}.css-1lzvamb:disabled,.css-1lzvamb[disabled]{cursor:not-allowed;-webkit-text-decoration:none;text-decoration:none;}Small Business, Guide to Cutting Costs to Increase Profits, Financial Planning for Nonprofit Organizations, Interested in automating the way you get paid? It's pretty simple, actually. Without a balance check tool, a business is at a higher risk of sending goods before receiving payment and customers are at a higher risk of unwittingly incurring overdraft fees. Recurring payments built for subscriptions, Training resources, documentation, and more. However, there are three main differences that it may be beneficial to highlight: the guarantee of payment, automated clearing house processing times, and fees. Also, since businesses can pass payment processing fees on to consumers, lowering the cost of doing business with ACH payments can mean lower costs for their customers. Image: A woman holding a document sits on the floor and uses her laptop and cellphone to assess her finances. Point-in-time snapshots of users' finances, Student loan, credit card, and mortgage data, Plaid builds connections that enable you to securely share your data, Plaid lets you securely share data from your financial institution with the apps you choose, Plaid powers the apps in your financial life, The pitfalls of ACH and how to avoid them, ACH benefits businesses and customers alike.

However, for most transactions, ACH is much cheaper than credit cards. ACH is widely used for many types of payments, including internet-initiated payments, peer-to-peer (P2P) payments, and direct deposits. payment prcua carte blanche gateway dss compliant pci certified fully secure pa through diners club This means theyll need to take actions such as verifying the customers identity, engaging in ongoing monitoring, and ensuring funds arent being used for money laundering or terrorism financing. It has to do with whos initiating the transfer. ACH Direct is the only payment processor you'll ever need. Essentially, ACH transactions are bank-to-bank payments for businesses in the United States. In addition to our industry-leading ACH solutions, we offer single and recurring credit card and debit card transaction processing. For regularly recurring payments such as monthly subscriptions, theres no reason for businesses to pay high processing fees every month.

However, for most transactions, ACH is much cheaper than credit cards. ACH is widely used for many types of payments, including internet-initiated payments, peer-to-peer (P2P) payments, and direct deposits. payment prcua carte blanche gateway dss compliant pci certified fully secure pa through diners club This means theyll need to take actions such as verifying the customers identity, engaging in ongoing monitoring, and ensuring funds arent being used for money laundering or terrorism financing. It has to do with whos initiating the transfer. ACH Direct is the only payment processor you'll ever need. Essentially, ACH transactions are bank-to-bank payments for businesses in the United States. In addition to our industry-leading ACH solutions, we offer single and recurring credit card and debit card transaction processing. For regularly recurring payments such as monthly subscriptions, theres no reason for businesses to pay high processing fees every month. iPhone is a trademark of Apple Inc., registered in the U.S. and other countries. Those points can be redeemed at several businesses, including Starbucks, Amazon, and Netflix. Better yet, Bill.com syncs with most major accounting software platforms, so you wont have to enter that payment twice. Businesses that accept ACH can create additional features that both benefit users and promote ACH payments. Then the recipient needs to process the mail and deposit the check. One of the common objections to using ACH for payments is that it takes too long to settle. Traditionally, ACH verification methods such as microdeposits and voided checks could take up to five days to process. People might use the terms ACH and EFT (electronic funds transfer) interchangeably, but theyre not the same. Find out how GoCardless can help you with ad hoc payments or recurring payments. We needed systems that were easy to implement and would serve as strong tools for our finance team. For customers to make the switch to ACH, it needs to be easy. With this type of payment you dont have to use paper checks, wire transfers, credit card networks or cash. ach

This is especially true for recurring payments like software subscriptions. Even though theyre electronic payments, it usually takes 24 business days for the transfer to complete. Box 30963, Oakland, CA 94604, Image: Young woman using a laptop in a cafe, Click to share on Twitter (Opens in new window), Click to share on Facebook (Opens in new window), Click to share on Reddit (Opens in new window), Credit Karma Money Spend 100% free to open, Image: Woman on couch looking at laptop, figuring out how much money to keep in her checking account, Image: Young man sitting on floor at home with digital tablet, looking up how to set up direct deposit, Image: Couple in kitchen with cellphone, talking about how to transfer money from bank to bank, Image: Man holding bill and calculator, figuring out why he was charged and NSF fee, Image: Woman at home in a sunlit room, wondering what a monthly maintenance fee is. One reason wire transfers may cost more is that theyre processed individually on a transaction-by-transaction basis directly from bank to bank, while ACH transactions are batched together for processing through a clearinghouse. So you dont have to worry about keeping enough money in your account to cover those checkspayments that might hit your account anywhere up to a month or more after you sent them. With online cart checkouts that make ACH as easy to use as a credit card once a bank account is linkedalong with the tools available to overcome some of ACHs setbacksits a viable option for businesses tired of paying high payment processing costs. Bill.com, the Bill.com logo, and the b logo are trademarks of Bill.com, LLC. First question: what is an automated clearing house transaction, anyway? All ACH payments are EFT payments, but not all EFTs are ACH. Take control: stop chasing late payments and save yourself time, money and stress. Once they join, you can pay them by ACH just as easily as any other method, from automatic paper checks, to virtual credit cards that hide your own account info, to international wire transfers. ach stored manage

On the Bill.com platform, making or receiving any ACH payment is very straightforward. 2022 Bill.com, LLC. ACH, EFT and eChecks: Which Is Right for My Business? 2006-2012 ACH Direct, Inc. All rights reserved. For affected companies, switching to ACH offers a simple way to increase long-term revenue by reducing payment churn. Its also safer than using paper checks, which can get lost, or worse, putting your name, address, and bank account info into the wrong hands and exposing you to check fraud. And, because of the way the system is set up, ACH payments can be stopped or returned under certain circumstances, much like other methods of transferring funds. By contrast, credit card processing times are slightly faster (it can be anywhere from 24 hours to three days from the transaction, although usually, youll receive payment immediately), which can improve your cash flow and boost liquidity. Thats all good information to have if you feel like talking about ACH payments with a banker, but none of it really matters if youre in the Bill.com system. And its much faster than sending a checknot just for your vendor, but for your own accounting. By making the ACH-payment experience user-friendly and easier to complete the onboarding processusers may be more likely to use it, leading to greater savings on fees over time. Dont give out your bank account information over the phone or online unless youre sure youre dealing with a reputable company. Why do so many businesses use the ACH system? Some may already prefer to pay with their bank account, such as the 57% of 18-31 year old Americans who dont have a rewards credit card. .css-y3jkrv{-webkit-align-items:baseline;-webkit-box-align:baseline;-ms-flex-align:baseline;align-items:baseline;margin:0;padding:0;-webkit-appearance:none;-moz-appearance:none;-ms-appearance:none;appearance:none;-webkit-user-select:none;-moz-user-select:none;-ms-user-select:none;user-select:none;border:none;border-radius:0;background:none;font-family:inherit;font-weight:inherit;font-size:inherit;line-height:inherit;color:inherit;width:auto;cursor:pointer;-webkit-text-decoration:none;text-decoration:none;-webkit-box-flex-wrap:nowrap;-webkit-flex-wrap:nowrap;-ms-flex-wrap:nowrap;flex-wrap:nowrap;text-align:left;font-size:inherit;line-height:inherit;background-color:transparent;color:#fbfbfb;font-size:16px;line-height:24px;width:auto;display:inline;}a.css-y3jkrv{-webkit-user-select:auto;-moz-user-select:auto;-ms-user-select:auto;user-select:auto;}button.css-y3jkrv{-webkit-user-select:none;-moz-user-select:none;-ms-user-select:none;user-select:none;}.css-y3jkrv:hover,.css-y3jkrv[data-hover]{-webkit-text-decoration:underline;text-decoration:underline;}.css-y3jkrv:hover,.css-y3jkrv:focus,.css-y3jkrv[data-focus]{background-color:transparent;color:#fbfbfb;}.css-y3jkrv:focus,.css-y3jkrv[data-focus]{outline:2px solid #7e9bf0;}.css-y3jkrv:active,.css-y3jkrv[data-active]{background-color:transparent;color:#f3f4f5;}.css-y3jkrv:disabled,.css-y3jkrv[disabled]{background:transparent;border-color:transparent;color:#8f9197;}.css-y3jkrv:disabled,.css-y3jkrv[disabled]{cursor:not-allowed;-webkit-text-decoration:none;text-decoration:none;}Learn more, GoCardless Ltd., 333 Bush St 4th Floor, San Francisco, CA 94104, USA.